CONTACT US

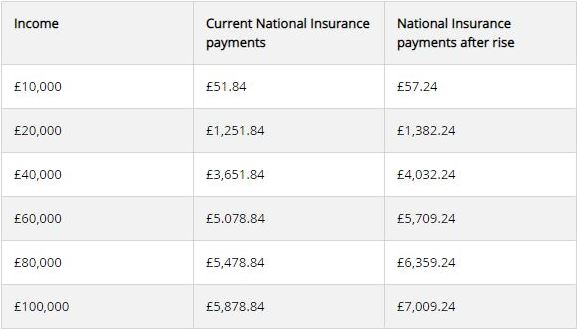

This is a reminder that from April 2022, your National Insurance contribution is set to rise through the introduction of a

1.25% Health and Social Care Tax Levy on earned income. Dividends rates are also set to increase by the same amount.

The Health and Social Care Levy will be paid by both employers and employees, including the self-employed, from April 2022. This will be extended in April 2023 to workers

above state pension age.

The following table shows the changes in payment amounts, for employees, following the introduction of the National Insurance increase.

What if I am self-employed?

1.25% will be added to the Class 4 National Insurance rate, however Class 2 National Insurance will be unaffected by the changes. For more information on whether you will be affected visit

gov.uk.

If you have any questions or would like to discuss your national insurance contribution further, please

contact your usual Moore adviser.