HMRC must prepare for busiest month with self-assessment deadline looming

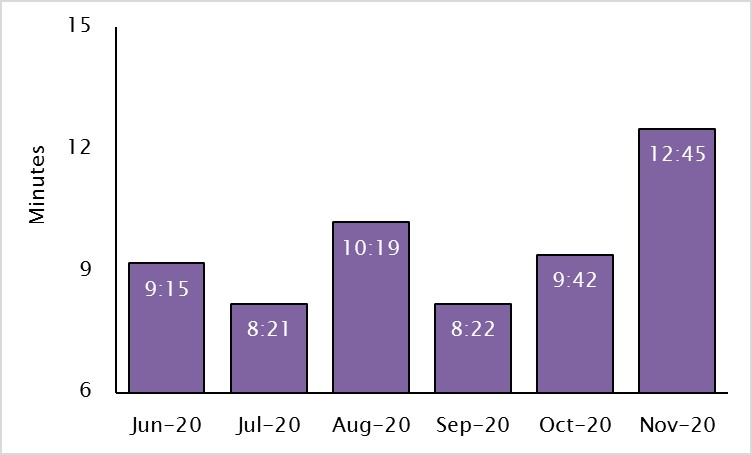

HMRC’s customer service levels have deteriorated with the average wait time for its customer helpline jumping 31% to 12:45 minutes in November 2020, up from 9:42 minutes in October, says Moore, the Top 15 accountancy firm.

Under-resourcing in HMRC’s customer service team means it is failing to respond to customers in a timely manner. Moore says that as result, taxpayers may be deterred from seeking assistance from HMRC, which could lead to them making significant mistakes on their tax returns and subsequently receiving penalties for underpaying tax.

Tim Woodgates, Associate at Moore, says: “When HMRC’s customer service levels fall, taxpayers can end up overpaying or underpaying tax. If customer service falls below a certain level, HMRC should consider reallocating some of its compliance staff to helping customers.”

“Like all organisations, HMRC is going to face logistical challenges from the pandemic and the lockdown, but we are now well over six months in, which should be enough time to adjust to the situation.”

Moore says HMRC may need to add more temporary staff to help with the imminent self-assessment deadline on January 31, which is one of the busiest times of the year for HMRC.

Previously, a large proportion of HMRC’s resources had been reallocated to help administer Covid-support schemes, such as the furlough and Self-Employment Income Support Scheme.

HMRC’s customer service experienced significant delays in November 2020, including*:

- 48% of customer calls had to wait for more than 10 minutes to be answered in November, up from 31% the previous month and 17% in November 2019

- Only 47% of iForms turned around in 7 days in November, down from 77% the previous month and 95% in November 2019

- Only 60% of post received by HMRC has been cleared within 3 weeks in November, down from 81% the previous month and 86% in November 2019

Tim Woodgates says: “The next self-assessment deadline is fast approaching and HMRC’s current performance is unlikely to give taxpayers much reassurance.”

“Nearly half of the 2.4 million customer calls in November had to wait for over 10 minutes to be answered.”

“Ensuring that coronavirus support schemes reach those who need them in a timely manner is extremely important – however, other matters are being pushed aside as a result. If customers do not get the assistance they require, this will only create more problems for HMRC in the long run.”

Wait times of HMRC’s customer helpline over the last six months (in minutes)

*HMRC, November 2020

**iForms: electronic versions of customer forms and can be used to report complaints to HMRC